Home Loan Solutions

Not all home loan solutions fit the needs of all buyers or those looking to refinance their mortgages. The right home loan for you will depend on your credit score, what you can afford, what your down payment looks like, and your debt-to-income ratio. Navigating the pitfalls of finding the ideal home loan is a task in of its self.

This is why you need an experienced, dedicated company life Diditan Financial to make sure you get the ideal home, with the right terms, and the lowest rate to fit your budget and meet your needs. Some of the most common types of mortgages people go after when applying for home loans include:

- Subprime Mortgages

- Jumbo Loan

- USDA Loan / RHS Loan

- FHA Loan

- Adjustable Rate Mortgage (ARM)

- Conventional Loan

- Conforming Loan

- VA Loan

- Fixed Rate Mortgage

- Home Equity Loans

The first thing you need to do is call our Diditan Financial team so we can go over your portfolio, help you determine how much house you can afford, what financing options you qualify for, and help secure something easy and highly manageable throughout the length of the loan term.

The worse thing you can do is get into a bad or predatory loan.

Our home loan specialists will educate you through every step of the process so that you understand all of your options and can make well-informed, confident decisions. We empower our client with knowledge.

What Kind of Home Loan is the Best Option for Buyers with Excellent Credit?

What is a Good Credit Score to Have for Getting a Home Loan?

A good credit score to have for getting a home loan hovers between 700 and 760. It goes without saying that if you have excellent credit, you will generally qualify for more home loan solutions that offer better rates and terms. That said, the lower your credit score, the more likely you pay higher interest rates. However, it is not that cut and dry. According to Bankrate.com, a credit score of 760 is generally the cut-off point where buyers can get conventional home loans with the best rates. However, at the time this data was gathered, Fannie Mae raises home loan rates underwritten on any credit score below 740. Then there are some lenders who will give good rates to buyers who score at least a 720, and some who even require a 700 or higher to get the best home loan rates. So what does this mean for a buyer who has a credit score somewhere between 700 and 760? It means you may get a conventional home loan under the impression you are getting the best rate possible, but in actuality there are other options that are more advantageous. This is why you need Diditan Financial working to find you the absolute best home loan solutions that truly reward your excellent credit score with terms and a rate that can’t be beat, because the real estate between a 700 and a 760 credit score is expansive, and needs to be prospected by home loan professionals who fight to get every break and benefit handed over to you. Diditan Financial has more than a decade of experience working diligently with aspiring home buyers to shop all possible options. We find home loan solutions often missed by the big bank spotlights that focus more on “sealing the deal” than providing exceptional customer care.

How are Credit Scores Judged by Home Loan Lenders?

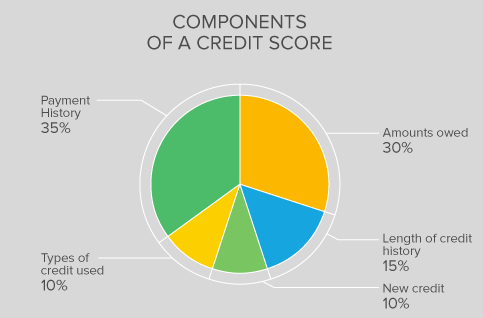

When we hear the term “credit score” what this really refers to is your FICO score–a number between 300 and 850 that represents one’s credit worthiness and forecasts the likelihood of them paying their mortgage off, and paying it on time. Basically, a person with a credit score of 850 is viewed as being the poster child of borrowers with virtually zero chance of faltering, while someone with a score of 300 is highly likely going to default on the loan. In order to really grasp how credit scores are judges by lenders, let’s first understand the formula. Developed by Fair, Isaac and Company (FICO) the components of the score baring its namesake takes the following factors into account, and in order of importance:

- Payment History – Have you paid off your debts in a timely manner?

- Amounts Owed – How high is the balance on your lines of credit, and how many do you have?

- Length of Credit History – How many years have you been using credit?

- New Credit – How many new credit accounts have you recently opened?

- Types of Credit Used – Do you have any retail accounts, credit cards, installment loans or other mortgages?

The above image is courtesy of Fico.com and illustrates the components of a credit score. Payment history and amounts owed highlight the bulk of the total score thus stressing their high level of importance. Your length of credit history consumes 15 percent, with types of credit and new credit accounting for 10 percent each. However, depending on the individual borrower and the type of mortgage being sought, these weights can shift. All of the information needed to calculate your credit score can be obtained by ordering your credit report. If you paid off that auto loan on your Honda Accord, opened up an American Express credit card, or forgot to pay your bill at Bloomingdales, all of this will show on your credit report.

Home Loans for Bad Credit

If you have bad to moderate credit, getting a home loan with the same rates of those seen above a 760 score will be out of the picture. However, with Diditan Financial working on your side, we can find amazing rates and a number of options to help you get the home of your dreams, even if you aren’t able to bask in the glory of a glowing credit score in the upper 700s.

If you have a minimum credit score of 620, and wish to offer a low down payment, you will likely qualify for an FHA loan. Underwritten by the Federal Housing Administration, lenders will take a bigger risk on borrowers with poor credit because the Federal government is taking some of the risk out of the equation. The FHA imposed a minimum credit score of 620 back in January 2013 for “automatic” underwriting. However, banks can set their own minimum credit score requirements, so even if the FHA approves your 620 credit score, banks may not. This is where Diditan Financial steps in; we find a lender that honors your credit score and sees value in your loan.

Subprime Mortgages

A subprime mortgage is a loan offered to borrowers with impaired credit who are not able to qualify for a prime loan or conventional loan. Subprime mortgages have higher interest rates in order to compensate the lender for the tremendous amount of risk being taken in backing a loan based off a “red flag credit score”. Be aware that subprime home loans can differ. Lenders consider a plethora of factors through a process called “risk-based pricing” that determines the mortgage rate and its terms. Your credit score determines how the the rate will be, and it takes many determining factors into account like what kind of delinquencies show up on the borrower’s credit report. For example, if Borrower A and Borrower B both have a credit score of 590, but Borrower A defaulted on several car payments and had his vehicle repossessed, while Borrower B has a stack of unpaid medical bills, a lender may look more favorably at Borrower B and give him a lower interest rate, even though it will still be higher than its standard prime cousin. In virtually all cases late mortgage payments are frowned on more than late credit card payments, so it really depends what kind of marks you have attached to your credit score. When you team up with Diditan Financial, we take all of these things into account when shopping the absolute best home loan solutions to meet your needs. In some cases, you may be able to repair your credit significantly and quickly, which would put you into a category to get a mortgage with better terms and a lower rate. At Diditan Financial we look out for our client’s best interests, at all times.

Are Balloon Payments Bad?

Subprime loans will likely have a balloon payment, pre-payment penalties, or even both. A balloon payment means the borrower has to pay off the remaining balance in a lump sum after a certain period has passed, which in most cases is five years. A balloon payment is not necessarily a bad thing as long as the terms are clear in spelling out what the amount will be, and as long as your income-to-debt ratio allows you to pay it when the time comes. You may think that paying the loan off before the balloon payment settles is the way to go, but you will likely pay penalties known as pre-payment penalties. In some cases a borrower will want to pay off the loan early so he can sell or refinance the home. In the event the buyer can’t pay the entire amount they must either refinance, get a hard money loan, or sell the home. If you are a first time home buyer working with a non-traditional lender in a subprime loan, Diditan Financial advises you to let us look at your paperwork before signing, as we are experts in this area. We also advise that you have a lawyer give everything a once over.

Do Your Need a Larger Loan for a Luxury Home? Consider the Jumbo Loan.

Jumbo Loans

If you have good credit and wish to borrow a loan amount that exceeds regulated conforming loan limits, you need to learn about a jumbo loan and consider it as a potential home loan solution that may meet your needs. Jumbo loans provide high-cost funding for the purchase of a luxury home, or for refinancing. These loans pose higher risk for lenders as opposed to traditional loans, so in order to qualify you must meet some fairly stringent requirements. Back when the bubble burst in 2008, lenders scaled back on offering these types of loans. However, they have slowly been reintroduced , and lenders are getting much smarting in offering them while protecting their investment. One of the biggest concerns to lenders is that if a borrower defaults on a jumbo loan, the home will be extremely difficult to sell at full price, and mainstream buyers are excluded. This is why qualifying for them is tricky, and involves clearing a lot of red tape.

Who Qualifies for a Jumbo Loan?

in order to qualify for a jumbo loan you must typically meet the following criteria:

- Have a credit score of 720 or higher

- Make a down payment of at least 20 percent

- Fully document your income

- Monthly mortgage payments can not exceed 38 percent of your gross income

One of the biggest myths in home loans is that jumbo loans come with a standard introductory rate that is extremely high. This is not always true. For example, if you are able to put a larger down payment on the table, your jumbo loan rate can come pretty close to matching the national average for a fixed rate mortgage. When you contact Diditan Financial we will do our research, examine your qualifying factors, and discuss this option with you in greater depth. A jumbo loan can present an ideal mortgage for the right buyer, and we are here to help you determine if it is your best option in the world of home loan solutions.

Dream of Renovating an Old Barn in the Countryside? The USDA Loan Might be Your Best Solution.

What is a USDA Home Loan?

The USDA loan program offers solutions for rural home loans backed by the United States Department of Agriculture. The USDA loan is also known as the USDA Rural Development Guaranteed Housing Loan and is available for rural businesses, single family units, and multi-family dwellings. So a USDA home loan is a mortgage loan for those looking to buy, build, or renovate properties in the countryside for residential or business needs. The USDA invested roughly $20 billion in a single year to help nearly 140,000 property owners purchase and renovate their homes. The purpose of the USDA loan program is to preserve rural American life and its economy. It offers a accessible mortgage, no down payments, and low interest rates.

How Do USDA Loan Programs Work?

There are three options for USDA loan programs that include:

Direct Loans: A direct USDA loan is a mortgage for low-income applicants issued by the USDA. The income windows vary from one region to another. You can pay as little as 1% on your interest rate, when subsidies are involved in the picture.

Loan Guarantees: Participating lenders issue the mortgage guaranteed by the USDA. This type of USDA loan is similar to a VA loan and FHA loan because like them, it allows you to get low mortgage interest rates without having to front a down payment. However, if you don’t put down an initial payment, be prepared to pay a mortgage insurance premium.

Home Improvement Grants and Loans: This variety of loan provides funds to rural homeowners to repair or upgrade their homes. It is fairly common for older rural homes to uncover some serious repair needs after purchase, such as addressing foundation or plumbing issues. There are many packages, and a combination of a loan and grant can provide as much as $27,500 in assisting the homeowner.

Diditan Financial can help you find the ideal solution to your urban home loan needs. Are you looking for a loan on a property outside the city that will be your place of residence or business? Our experts can help you qualify for the ideal USDA loan, and ensure you get the best terms and lowest interest rates.

Do I Qualify for a USDA Loan?

In order to determine if you qualify for the USDA loan, you must first make sure your home’s location is within the boundaries of rural zoning. You can start by consulting the USDA eligibility map to make sure your locale falls within the government’s rural mapping approval zone. Metropolitan areas are excluded from this home loan, however there are scattered pockets of suburban homes that qualify. In order to be eligible for a USDA-backed mortgage guarantee you must apply as an owner-occupied primary residence. Other eligibility requirements include, but are not limited to:

- Demonstrate dependable income with a typical minimum of 24 month’s history

- U.S. citizenship or permanent residency

- Acceptable credit history with the last 12 months showing no collections. However, if there were temporary circumstances out of your control such as lost wages due to a natural disaster, or if you had a medical emergency, your credit may be taken into consideration allowing you to still qualify

- Your monthly payments (including interest, principal, taxes and insurance) must add up to a sum no greater than 29% of your income. All remaining debt payments can not exceed 41% of your income. The only exception is if you have a credit score greater than 660–in this case a higher debt ratio could be considered.

Be aware that income limits to qualify for a USDA-backed mortgage loan vary based on the size of your household and the location of the property.Borrowers with credit scores lower than 580 will face stricter underwriting standards, while those with credit scores of 620 or higher will benefit from lightning-quick processing. That said, you may want to consult our Diditan Financial experts if your loan revolves around time frames, as it might be in your best interest to do a little “credit repair surgery” before filling out the loan application.

How Does a USDA Home Loan Work?

The USDA awards mortgages to those they consider to have the greatest need. Some of the circumstances the government takes into account when determining those with the most urgent hardship includes:

- Folks unable to qualify for traditional home loans

- Families without “decent, safe, and sanitary housing”

- People struggling with an adjusted income at or below the low-income barrier set for the area where they wish to own a home

Generally, the USDA will give a direct loan on homes with a market value lower than the area’s location loan limit, and on houses sized 1800 square feet or less. A home loan being sought in more expensive markets like California and Hawaii can be as high as $500,000 or as low as $100,000 in states like Kansas or Nebraska. The national average for a USDA home loan limit is $216,840. Be sure to contact Diditan Financial to learn more about the limitations, grants, benefits and terms your USDA home loan poses.

Do You Qualify for a FHA Loan?

Can I Qualify for a FHA Loan?

An FHA loan is a mortgage solution granted by the Federal Housing Administration in which borrowers have a mortgage insurance protecting lenders from potential loss in the event the buyer defaults on the loan, and all lenders must be FHA-approved. These loans are insured on single family and multi-family homes in the United States and is the largest insurer of residential mortgages in the world having insured multiple millions of homes since its creation in 1934. To qualify for a FHA loan you need a minimum credit score of 580 on a mortgage with a down payment of 3.5%. If your credit score is between 500 and 559 you will need to put 10% down. An FHA loan generally doesn’t have income requirements, however you will need documentation to prove that your income is large enough to cover your mortgage payments, as well as other monthly financial obligations and debts. The standard debt-to-ratio must not exceed 43%. In some cases, however, the manual approval of an application can be met with a debt-to-income ratio up to 45%. When you call Diditan Financial our loan vanguards will work all night to make sure the best terms on a FHA loan are yours, and that you don’t fall prey to overpaying.

To qualify for a FHA loan you will need to have a clear CAIVRS report (Credit Alert Verification Reporting System). This is a system that tracks individuals with delinquencies in which they owe money to the Federal Government. In other words, if you took out a FAFSA educational loan to pay for your PhD and you defaulted on payments, you would need to pay back your student loans before you could qualify for a FHA loan. This includes Small Business Administration (SBA) loans, or other FHA loans. However, if you are under a federally-approved repayment plan supported by the government agency that holds your loan, you may still qualify for a FHA-backed loan.

How can a FHA Loan Help?

An FHA loan can help buyers in a variety of ways. Some of these include:

- Buying your first home

- Making your home energy efficient

- Making a mortgage affordable for seniors

- Assisting those wanting to purchase a mobile home

If you are looking for a home loan for first time buyers, a FHA loan may be your ideal solution because the interest rates can be as low as 3.5% of the home’s value. You can also use a FHA loan to finance the extra costs of making your home more energy efficient through the FHA energy-efficient mortgage. If you plan on installing solar power panels on your roof, solar outdoor lighting, and energy efficient heating and cooling systems, this may be an ideal loan to meet your needs. People aged 62 or older who live in a home they own outright and who have a remaining balance on their mortgage that is low may qualify for a FHA reverse mortgage. You have options when it comes to reverse mortgages, so be sure to call Diditan Financial so we can help you find your ideal solution based on your goals and unique situation. If you are considering the purchase of a mobile home to be used as your primary residence, you are becoming part of a growing trend of people who want to downsize or find more affordable living options. FHA loans are available for mobile homes, as well as factory-made homes (tiny homes). There are two types of these loans: one for a mobile home that will reside in a mobile home park, and the other for a mobile or factory-made home in which you own the land it will sit on, or will soon purchase that land.

Is an Adjustable Rate Mortgage a Good Idea?

When examining adjustable rate mortgage pros and cons, you must first consider how these home loan solutions work within the context of your needs, portfolio and unique standing. The adjustable rate mortgage (ARM) definition defines exactly what the term sounds like–monthly payments can move up or down as interest rates fluctuate. When asking the question, is an adjustable interest rate right for me, you will want to make sure you can afford payments if the amount reaches its max peak. Most ARMs have an initial period in which the rate is fixed at a low percentage followed by a a time frame in which it changes and fluctuates like a roller coaster.

What are the Pros and Cons of Fixed and Adjustable Rate Loans?

An adjustable interest rate mortgage has its benefits, but it also has its downsides.

The Pros:

- In most cases, you start with a lower interest rate compared to a fixed-rate mortgage.

- Your interest rate can lower once the fixed-rate duration ends, and this means your monthly payments can also go down.

The Cons:

- Once the fixed-rate duration ends, your interest rates can go up, and so too can your payments.

- You have to deal with an unpredictable climate–you don’t know if and when rates will go up or down and therefore have no way of knowing how much your payments will be.

Someone who opts for an adjustable rate mortgage is a lot like a smart Vegas gambler: you bet on a prosperous scenario but always have enough in your pocket to cover a loss. In other words, an ARM is not ideal for someone who is simply gambling on low rates throughout the entire duration of the loan but who can’t afford to make payments should the rates hit the ceiling. Our Diditan Financial team advises all buyers to only consider an adjustable rate mortgage if they can afford potential payments at the high end of the interest rate spectrum.

What is a 5/1 ARM Mortgage?

A 5/1 ARM loan is an adjustable rate mortgage in which the first five years has a fixed rate. Once the five-year period has passed, the rate can adjust once every year throughout the remainder of the loan. Rates can either go up or down, with no guarantee. A 5/1 ARM mortgage is often an ideal home loan solution for someone who is starting a new job in a few years, or who knows they will be stepping into a promotion with a significant salary increase allowing the ability to cover mortgage payments in the event the rates go sky high. These borrowers can enjoy an affordable foreseen rate in the first five years, and not sweat the future.

What is a 10/1 ARM Mortgage?

You guessed it; the same rules apply for the 5/1 option, only in this case a 10/1 ARM mortgage is a loan with an adjustable rate mortgage in which the first 10 years have a fixed interest rate. During that time the rate stays frozen and will not move up or down. After the 10-year period is up, your rates will move year-to year, either going up or down at what could be a moderate or dramatic pace.

What is a Conventional Loan?

A conventional loan is a mortgage that isn’t guaranteed or insured by the Federal government. It can have an adjustable or fixed rate, and it adheres to the guidelines established by Fannie Mae and Freddie Mac. Conventional loans exclude home loan solutions such as Farmers Home Administration (FmHA), the Federal Housing Administration (FHA), the U.S. Department of Agriculture (USDA) and the Department of Veterans Affairs (VA). Mortgage loans that are not insured or guaranteed by these agencies fall into the category of conventional loans, and the most popular types include:

- Jumbo loans

- Non-conforming loans

- Conforming loans

- Sub-prime Loans

- Portfolio loans

So long as a private lending institution like a bank or a corporation of investors handles insures and guarantees your loan, and the Federal government has nothing to do with it, you may be dealing with a conventional loan.

What is the Difference Between a Conforming Loan and a Conventional Loan?

People often think that conforming loans and conventional loans are interchangeable, but they are two completely different types of loans. While a conventional loan is not guaranteed or insured by the Federal government, a conforming loan is eligible through Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation). In other words some conventional loans can also be conforming mortgages, but not all of them.

Since 2007, many sub-prime mortgages have vanished into thin air making conventional or conforming loans ideal home loan solutions for potential homeowners with sterling credit. If a borrower doesn’t make enough money, has an exemplary credit report, or cash on hand, the FHA mortgage is an ideal choice because you only need to put 3.5 percent down making the dream of home ownership a reality for first-time buyers and younger buyers. However, all that said, conventional and conforming mortgages are still number one when it comes to popular majority in the world of home loans. When you call Diditan Financial our experts will examine your credit, analyze your debt-to-income ratio, and present you with the best home loan option. In most cases, a conventional or conforming loan is always put forward.

How do VA Loans Work?

Va loans are ideal home loan solutions for veterans who were honorably discharged, or who retired from one of the armed service branches of the US military. The loan is guaranteed by the US Department of Veteran Affairs (VA) and is issued by lenders who qualify to work with the program. This mortgage option offers long-term financing to eligible US veterans and their surviving spouses, so long as their partners do not remarry. If you want to know who qualifies for a VA loan, explore our site and learn all about the qualification process and discover how Diditan Financial can help you get a VA home loan with amazing terms and low monthly mortgage payments with the lowest rates possible!